The Current Ratio is a liquidity ratio that measures a company’s capacity to cover its short-term liabilities with its current assets. This ratio is vital in evaluating the financial health of a company, indicating whether it has enough short-term assets to cover its short-term debts. A higher current ratio suggests better short-term financial health. Generally, a ratio above 1 is considered good as it indicates that the company has more current assets than current liabilities. However, a very high ratio may suggest that the company is not effectively using its current assets or its short-term financing facilities. In comparison to Cash Ratio and Quick Ratio, the Current Ratio includes all current assets.

This page covers the following topics related to Current Ratio:

General Formula

Current Ratio = Current Assets / Current Liabilities

- Current Assets: Assets that expected to be converted into cash within one year. It includes cash and cash equivalents, short-term investments, accounts receivable, inventory, and other liquid assets

- Current Liabilities: Obligations that needs to be settled within a year

The Current Ratio is a quick measure of liquidity and is particularly useful for creditors, lenders, and investors to assess the company’s short-term financial strength and risk level. It’s a more comprehensive measure than the Cash Ratio and Quick Ratio as it includes other assets like receivables and inventory in addition to cash and cash equivalents.

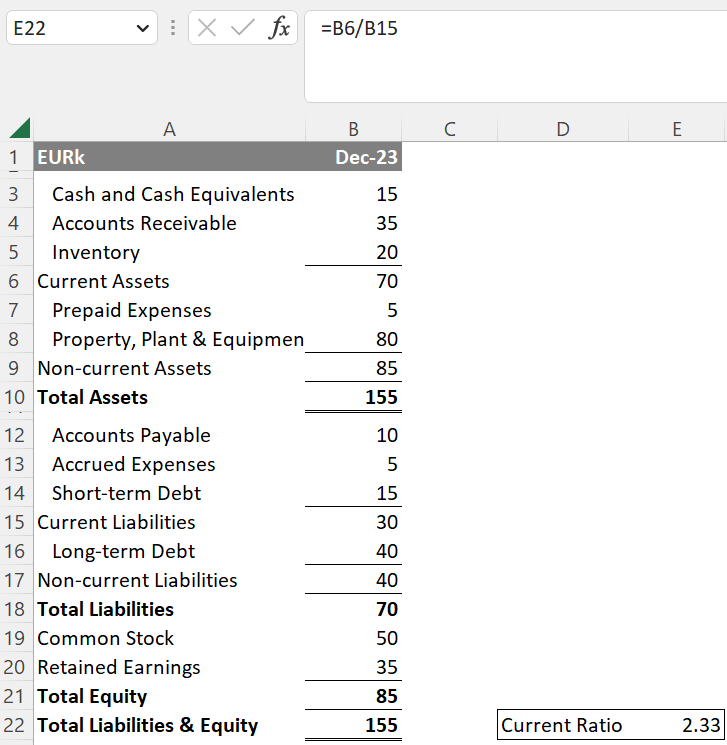

Application in Excel

To calculate the Current Ratio in Excel, you can use a division formula. Assume the company’s current assets are in cell B6 and its current liabilities are in cell B15.

The Current Ratio is a straightforward yet powerful tool for financial analysis, allowing quick evaluation of a company’s short-term liquidity position.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.