The Debt-to-Asset Ratio measures the extent to which a company’s assets are financed by debt. A higher ratio suggests that a greater proportion of a company’s assets are financed through debt, indicating higher financial leverage and potentially higher financial risk. Conversely, a lower ratio implies less leverage and potentially lower risk. This ratio is essential for creditors and investors to assess the financial stability and risk profile of a company. It’s crucial for understanding how effectively a company is using its assets to generate earnings while managing its debt obligations.

This page covers the following topics related to Debt-to-Asset Ratio:

General Formula

Debt-to-Asset Ratio = Total Debt / Total Assets

- Total Debt: Company’s liabilities that require payment of interest, including short-term and long-term debts, loans, and bonds payable.

- Total Assets: Company’s resources with economic value, such as cash, inventory, property, and equipment.

In practical usage, the Debt-to-Asset Ratio is a key indicator of financial stability. A high ratio may indicate a heavy reliance on debt financing and potential difficulty in meeting these obligations, especially in financial downturns. On the other hand, a very low ratio might suggest an overly cautious approach to financing that could hamper growth opportunities.

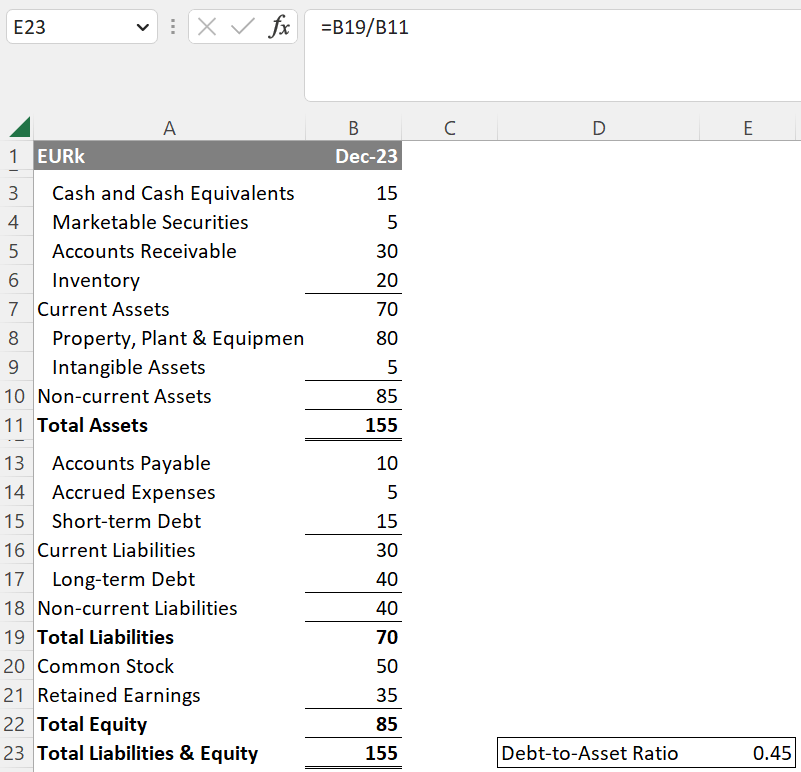

Application in Excel

To calculate the Debt-to-Asset Ratio in Excel, you would typically have the total debt and total assets figures inputted in specific cells.

This Excel formula calculates the ratio by dividing the total debt by the total assets. This ratio is beneficial for financial analysis, particularly in assessing a company’s leverage and financial health. It can also be used in comparative analysis against industry benchmarks or historical data of the company.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.