The Debt-to-Equity Ratio is used to understand the degree to which a company is financing its operations through debt versus wholly-owned funds. It’s a measure of the relative proportion of shareholders‘ equity and debt used to finance a company’s assets. A lower ratio is generally perceived as favorable, indicating that a company is not excessively reliant on debt and has a more conservative financing structure. Conversely, a higher ratio suggests that a company might be at risk due to heavy debt financing, which could be problematic during economic downturns or periods of high interest rates.

This page covers the following topics related to Debt-to-Equity Ratio:

General Formula

Debt-to-Equity Ratio = Total Liabilities / Shareholder’s Equity

- Total Liabilities: All debts and financial obligations owed by the company, such as loans, bonds payable, and lease obligations.

- Shareholder’s Equity: Residual interest in the assets of the company after deducting liabilities

Practically, the Debt-to-Equity Ratio helps investors and analysts understand how a company is leveraging its debt against the equity provided by its shareholders. A company with a high ratio might face higher interest payments, which could impact its profitability. However, some industries naturally operate with higher ratios due to their business nature.

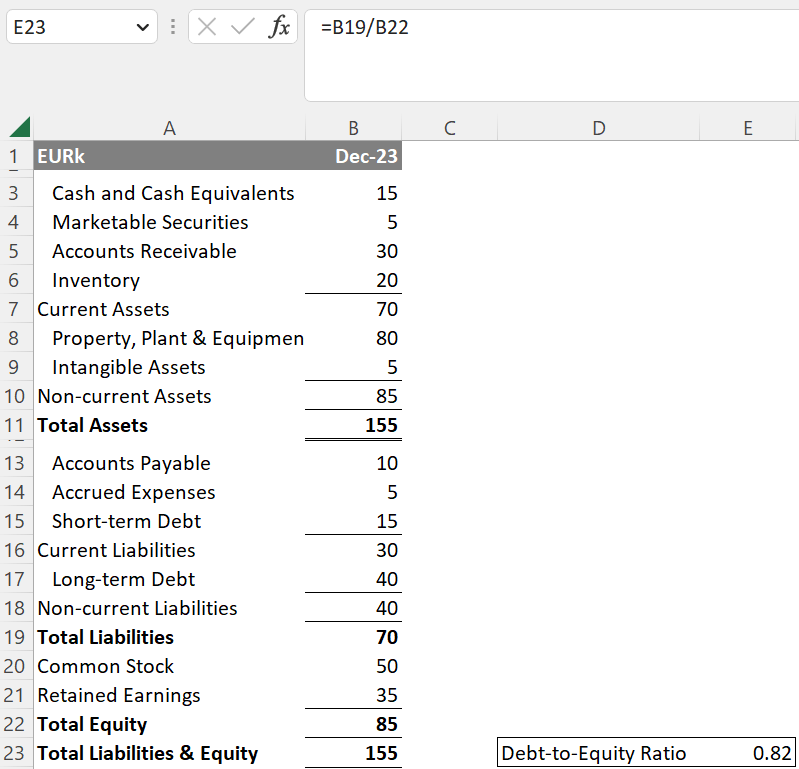

Application in Excel

To calculate the Debt-to-Equity Ratio in Excel, you will use a simple division formula.

The Debt-to-Equity Ratio is particularly valuable for financial analysis, aiding in the assessment of a company’s financial leverage and risk profile.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.