Executive Summary

The Dividend Discount Model (DDM) is a valuation method used in finance to estimate the value of a company’s stock. It accounts for the present value of all future dividends, adjusting for the time value of money. Investors use this model to determine whether a stock is overvalued or undervalued based on the projected future dividends and the required rate of return.

Formula Deep Dive

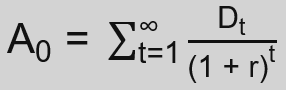

- Value of Equity (A0): describes the the total present value of stock in year 0.

- Dividends (Dt): represents the expected total dividends for each year t.

- Required Rate of Return (r): is the investor’s desired rate of return, considering the risk associated with the investment.

The DDM focuses on estimating the present value of a stock by considering the sum of all discounted future dividend payments. The formula takes into account the varying dividends (D) expected in each future year and discounts them back to their present value. The discount rate represented by the required rate of return (r) can be determined through the Capital Asset Pricing Model (CAPM). Each year’s dividend is adjusted for the time value of money, factored through the exponent (t), which represents the number of years into the future.

Additional Formulas

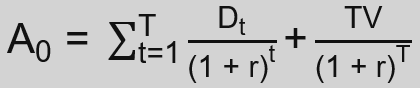

- Value of Equity (A0): describes the total present value of stock in year 0.

- Dividends (Dt): represents the expected total dividends for each year t.

- Required Rate of Return (r): is the investor’s desired rate of return, considering the risk associated with the investment.

- Terminal Value (TV): represents the present value of all future dividends to pay beyond a forecast period T.

The terminal value (TV) is typically calculated using the Gordon Growth Model or another suitable method and it represents the stock’s value at the beginning of the stable growth phase.

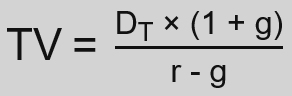

- Terminal Value (TV): describes the present value of all future dividends to pay beyond a forecast period.

- Dividends (Dt): represents the expected total dividends for each year t.

- Required Rate of Return (r): is the investor’s desired rate of return, considering the risk associated with the investment.

- Growth Rate (g): represents the constant growth rate of dividends expected after year T.

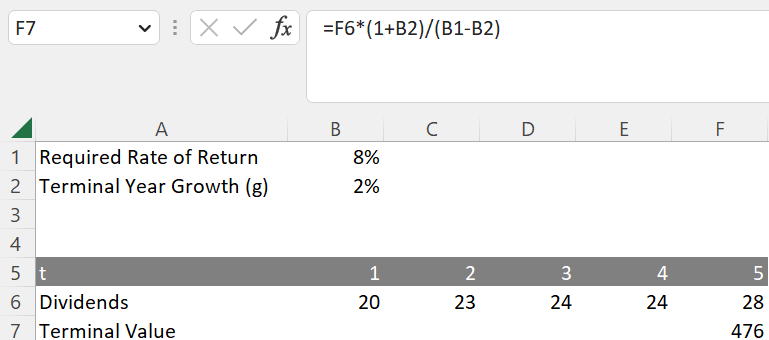

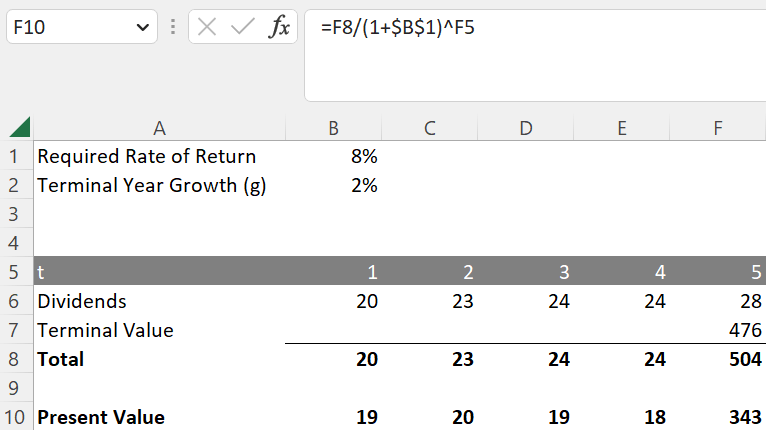

Application in Excel

To apply the DDM in Excel, as a first steps, one needs to determine the required rate of return (cell B1), the terminal year growth (cell B2) and the future the dividends within the forecast period (cells B6:F6). Further, the terminal value can be calculated as follows:

=F6*(1+B2)/(B1-B2)

To get the present value for each year, we can first calculate the sum for each year individually and discount it thereafter. As an example, to calculate the present value for year 5, the following formula can be applied:

=F8/(1+B1)^F5

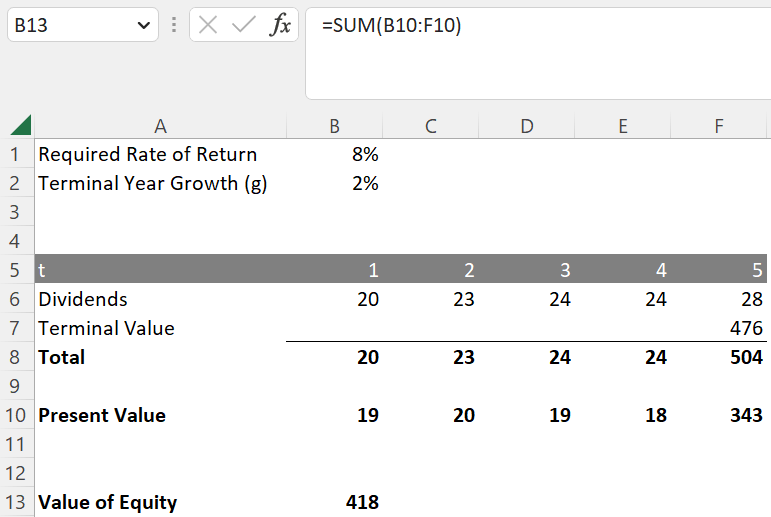

To determine the value of equity, all present value need to be summed up:

=SUM(B10:F10)

This formula calculates the present value of each year’s dividends and sums them up to find the total present value of the stock. This model is widely used by investors and analysts who focus on dividend-paying stocks, particularly in sectors where dividend payouts are a significant component of investor returns.

See also:

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.