The EBIT Margin is a financial metric that shows what percentage of a company’s revenue is operating profit, before interest and taxes are deducted. It is a measure of a company’s operating efficiency and profitability. A higher EBIT Margin indicates more efficient cost management and potentially greater profitability. It’s particularly useful for comparing companies within the same industry or for evaluating a company’s operational performance over time.

This page covers the following topics related to EBITDA Margin:

Formula Deep Dive

EBIT Margin = EBIT / Revenue

- EBIT: Earnings Before Interest and Taxes

- Revenue: Total income earned from the sale of goods and services

The EBIT Margin offers insight into how well a company is managing its core business operations, as it excludes the impact of financial and tax strategies. It’s often used by investors and analysts to assess the operational efficiency of a company, especially when comparing similar companies in the same industry where those external factors might differ.

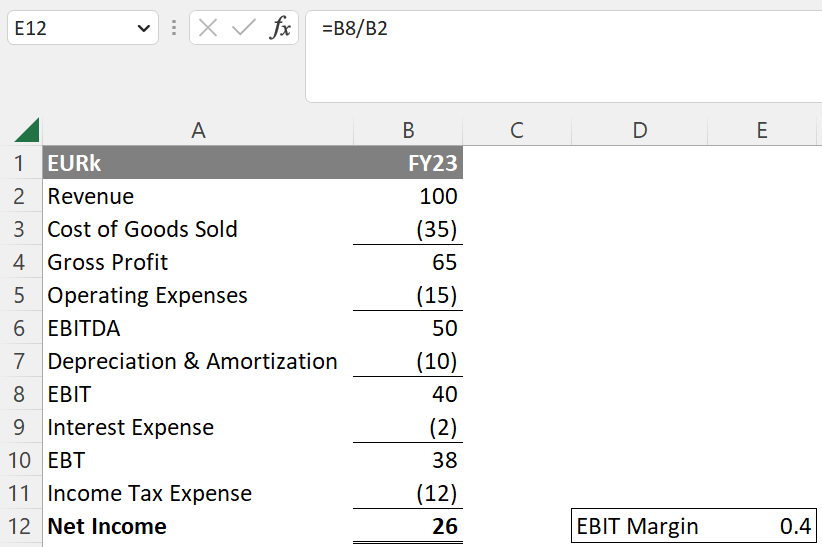

Application in Excel

To calculate the EBIT Margin in Excel, you would typically use the following formula: EBIT / revenue. In the example below, EBIT is recorded in cell B8 and the Revenue is in cell B2.

This formula will return the EBIT Margin as a decimal. This margin is particularly useful for financial analysts and managers in assessing operational efficiency and making cross-company comparisons.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.