EBITDA Margin is a widely used performance metric in finance, particularly useful for comparing the profitability of companies within the same industry. It helps in understanding how much operating cash is generated for each dollar of revenue. By excluding interest, taxes, depreciation, and amortization, the EBITDA Margin focuses purely on a company’s operational efficiency without the impact of financial and accounting decisions. Generally, a higher EBITDA Margin indicates a more financially stable and profitable company. However, it should not be used in isolation but rather in conjunction with other financial metrics.

This page covers the following topics related to EBITDA Margin:

General Formula

EBITDA Margin = EBITDA / Revenue

- EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization

- Revenue: Total income earned from sales of goods or services

The EBITDA Margin is particularly useful for investors and analysts as it provides a clear view of a company’s operational profitability by removing the effects of non-operating factors like tax rates, interest expenses, and non-cash accounting items like depreciation and amortization. It’s especially helpful in industries where companies have large amounts of fixed assets which are subject to significant depreciation and amortization.

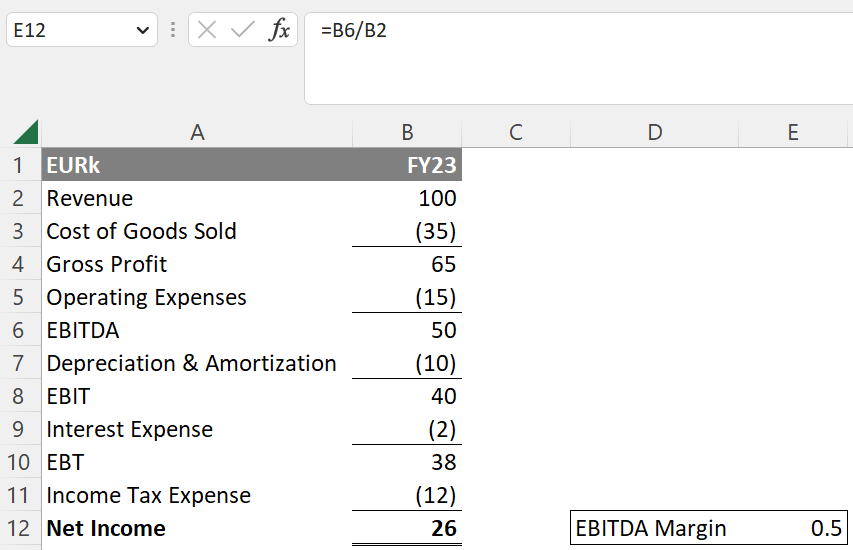

Application in Excel

To calculate the EBITDA Margin in Excel, one divides EBITDA by revenue as shown below.

This formula will calculate the EBITDA Margin as decimal. This calculation is particularly valuable for financial analysts, investors, and stakeholders looking to gauge a company’s operational efficiency and compare it with peers.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.