Executive Summary

The EV/EBITDA multiple, also known as the enterprise multiple, measures a company’s overall value compared to its EBITDA. It is used to determine the value of a company in a way that is neutral to capital structure and accounting decisions. Generally, a lower EV/EBITDA multiple suggests that a company might be undervalued, while a higher multiple can indicate overvaluation. This metric is particularly useful in mergers and acquisitions and for comparing companies with different levels of debt.

Formula Deep Dive

Enterprise Multiple = EV / EBITDA

- Enterprise Value (EV): is the profit of a company after all expenses and taxes have been deducted from revenue.

- Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): represents a company’s earnings before any deductions for interest expenses, taxes, depreciation, and amortization.

The practical usage of the EV/EBITDA multiple lies in its ability to provide a normalized comparison across companies and industries, as it minimizes the effects of different capital structures and taxation strategies. It is particularly favored in industries with high levels of depreciation and amortization, like telecommunications or utilities.

Additional Formulas

Equity Value = EV – Debt + Cash and Cash Equivalents

This formula begins with the EV, which represents the total value of the company including debt and equity. The EV can be obtained through the EV/EBITDA multiple based on the company specific EBITDA and the typical industry values of the enterprise multiple. Debt is subtracted because it represents the interest of debt holders, not equity holders. Cash and cash equivalents are added back because they reduce the net debt position of the company. This calculation isolates the value that is attributable solely to the company’s equity holders.

Application in Excel

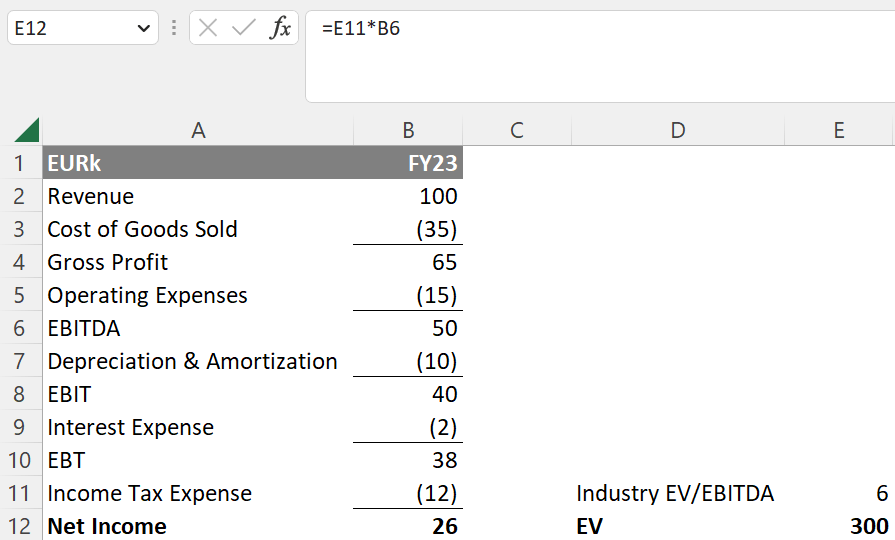

To calculate the EV/EBITDA multiple in Excel, you would typically gather the necessary data and input it into the spreadsheet. In the example below the EBITDA is in cell B6. We further assume that the industry typical EV/EBITDA multiple is 6 which is in cell E11. The EV can then be calculated as follows:

=E11*B6

This Excel formula divides the Enterprise Value by EBITDA to yield the EV/EBITDA multiple. Financial analysts often use this ratio when comparing companies within the same industry or when assessing a company’s value for potential mergers or acquisitions.

See also:

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.