Gross Margin is a crucial financial metric used to assess the financial health and operational efficiency of a company. It represents the proportion of each dollar of revenue that the company retains as gross profit after accounting for the cost of goods sold (COGS). This margin is key in understanding how efficiently a company is producing and selling its products. A higher gross margin indicates that a company is selling its products at a relatively high profit, which can be a sign of good management and production efficiency. Conversely, a low Gross Margin might suggest that a company is struggling to control its production costs or is not able to command higher prices for its products.

This page covers the following topics related to Gross Margin:

General Formula

Gross Margin = (Revenue – Cost of Goods Sold) / Revenue

- Revenue: Total income generated from the sale of goods or services

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold by the company (e.g. material costs)

The Gross Margin is often used by management and investors to compare a company’s business model and operational efficiency with that of its competitors. Higher gross margins can give a company a competitive edge, as it may indicate better control over production costs or the ability to sell at higher price points. It is also a useful indicator for pricing strategies and product line profitability.

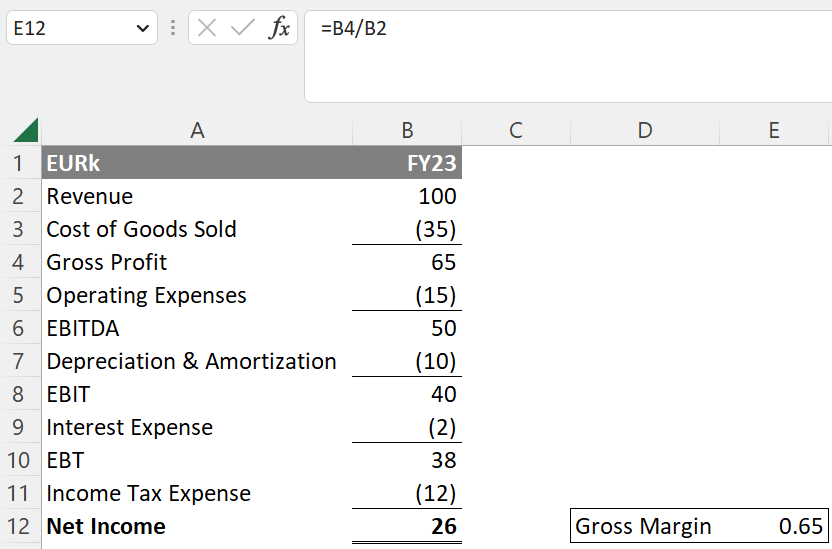

Application in Excel

To calculate the Gross Margin in Excel, you would typically deduct the cost of goods sold from the revenue and then divide the result by the revenue. In the example below, we can directly use the company’s gross profit in cell B4 and its revenue in cell B2.

This Excel formula divides the gross profit by the revenue to get the Gross Margin as decimal. This calculation is particularly useful for financial analysts, business owners, and investors who aim to assess the profitability and efficiency.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.