The Quick Ratio provides a more stringent measure of liquidity compared to the Current Ratio as it excludes inventory from its calculation. It focuses solely on the most liquid assets: cash, marketable securities, and receivables. A higher Quick Ratio indicates a company’s strong position in covering its current liabilities without needing to sell inventory, thus offering a clearer view of its short-term financial health and liquidity.

This page covers the following topics related to Quick Ratio:

General Formula

- Cash and Cash Equivalents: Cash assets or assets that can be quickly converted into cash

- Marketable Securities: Liquid financial instruments that can be quickly converted into cash at a reasonable price

- Accounts Receivable: Money owed to the company by its customers for goods or services delivered or used but not yet paid for.

- Current Liabilities: Obligations that needs to be settled within a year

The practical use of the Quick Ratio lies in its ability to give a snapshot of a company’s financial health, particularly its short-term liquidity. It’s especially valuable in analyzing companies in industries where inventory is less liquid or takes longer to turn into cash. It’s a crucial tool for creditors and investors to evaluate a company’s capacity to pay off its short-term obligations without relying on the sale of inventory.

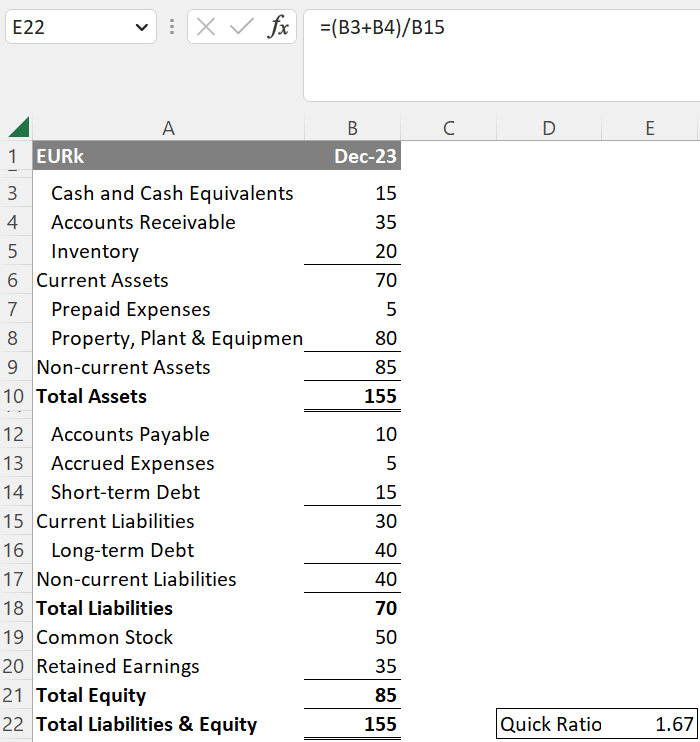

Application in Excel

To calculate the Quick Ratio in Excel, you would typically have different cells representing each component of the formula.

The Quick Ratio is particularly useful for financial analysts, creditors, and investors in assessing a company’s liquidity and its ability to quickly meet its short-term debts.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.