Return on assets (ROA) provides insights into a company’s profitability relative to its total assets. It is a measure of the effectiveness with which a company’s management is using its assets to generate earnings. ROA is crucial for comparing the profitability of companies in the same industry as it reflects the efficiency of asset use irrespective of the size of the company. A higher ROA indicates a more efficient use of company assets to generate profit.

This page covers the following topics related to ROA:

Formula Deep Dive

Return on Assets (ROA) = Net Income / Total Assets

- Net Income: Profit of a company after all expenses have been deducted

- Total Assets: Everything a company owns that has value

The significance of ROA lies in its capacity to assess the managerial effectiveness in using assets to generate profit. It’s particularly useful for investors and analysts as it gives a snapshot of a company’s operational efficiency. ROA is also beneficial when comparing companies within the same industry but of different sizes, as it gives a proportionate measure of profitability.

Application in Excel

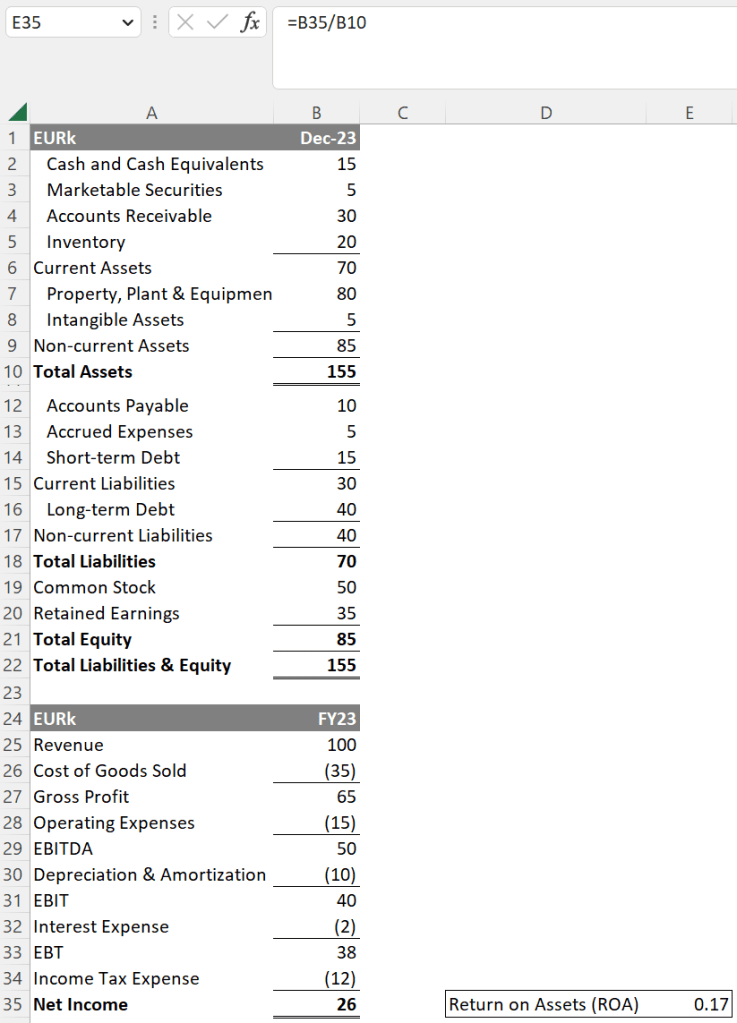

To compute ROA in Excel, you would typically have a cell with the net income and another with the total assets. In the example below, the net income is in cell B35 and total assets are in cell B10.

This Excel formula divides the net income by the total assets, resulting in the ROA. The resulting ROA is a handy tool for financial analysts and investors to evaluate the efficiency of a company’s asset utilization in generating profits.

Related Topics

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.