Executive Summary

The Weighted Average Cost of Capital (WACC) represents a firm’s blended cost of capital across all sources, including both debt and equity. It reflects the average rate of return a company must earn on its investment projects to maintain its asset value and satisfy its creditors and investors. A lower WACC suggests a cheaper cost of financing and investment, potentially leading to higher profitability and value creation for shareholders.

Formula Deep Dive

- Market Value of Equity (E): is the total value of a company’s ownership interest as determined by the stock market. It is calculated by multiplying the current market price per share by the total number of outstanding shares.

- Cost of Equity (rE): indicates the return required by equity investors. In practice, the cost of equity (rE) can be determined by using the Capital Asset Pricing Model (CAPM).

- Market Value of Debt (D): represents the total value of a company’s financial obligations or debts, as perceived by the market. This can include short-term and long-term debt such as bonds, loans, and other forms of financial liabilities.

- Cost of Debt (rD): describes the effective rate a company pays on its borrowed funds.

- Corporate Tax Rate (T): is the percentage of a company’s profits paid as income tax to the government. It impacts the cost of debt due to the tax deductibility of interest.

The formula combines the cost of equity (rE) and the cost of debt (rD), each weighted by their respective proportions in the company’s overall capital structure (E + D). The cost of debt is adjusted for taxes since interest expenses are tax-deductible, reducing the effective interest cost for the company.

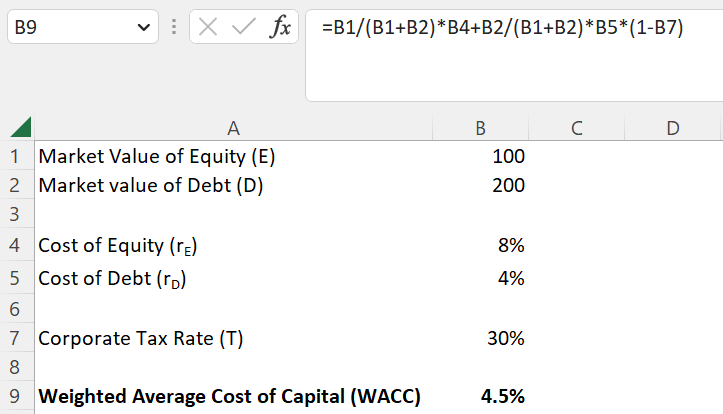

Application in Excel

Excel is capable of performing calculations for the WACC for a project or a company. As demonstrated in the subsequent example, the market value of equity (E), located in cell B1, is 100, while the market value of debt (D), found in cell B2, is 200. Additionally, the cost of equity (rE) is set at 8%, and the cost of debt (rD) at 4%. The corporate tax rate (T) is established at 30% as shown in cell B7. The formula presented below outlines the process for calculating the WACC.

=B1/(B1+B2)*B4+B2/(B1+B2)*B5*(1-B7)

In practical applications, WACC is primarily used as a discount rate for evaluating the present value of future cash flows in the Discounted Cash Flow Model (DCFM) to support investment decisions and business valuation. It is fundamental in capital budgeting to assess project viability, ensuring that only investments exceeding this threshold rate are pursued.

See also:

Disclaimer: The information provided on this website is for educational purposes only and is not intended for use as legal, financial, or tax advice. While every effort is made to ensure the accuracy and reliability of the content, Maths for Finance makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will Maths for Finance be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Please further review our Terms of Service.